30+ How much will mortgage lend me

Hit enter to search or ESC to close. The length by which you agree to pay back the home loan.

How Would The Federal Tapering Affect Me Economy Infographic Mortgage Interest Rates Mortgage Payoff

Points are a way to buy a lower interest rate.

. Mortgage rates increased following the news of the bailout plan. Mortgage Amount Capital 212500. Lenders mortgage insurance LMI can be expensive.

If you bought a 600000 house with a 5 deposit of 30000 then your LMI premium could cost over 22000 based on Finders LMI estimator. Added 366 - days-per-year optionThis setting impacts interest calculations when you set compounding frequency to a day based frequency daily exactsimple or continuous or when there are odd days caused by an initial irregular length period. 500 PM Early Access.

With an interest only mortgage you are not actually paying off any of the loan. Amazing service and communication. Saturday April 30 2022.

Getting ready to buy a home. All inputs and options are explained below. Filters enable you to change the loan amount duration or loan type.

We provide conventional FHA VA USDA Loans. The mortgage should be fully paid off by the end of the full mortgage term. By default 30-yr fixed-rate loans are displayed in the table below.

This home loan has relatively low monthly payments that stay the same over the 30-year period compared to higher payments on shorter term loans like a 15-year fixed-rate mortgageIf you prefer predictable steady monthly. For example a 30-year fixed mortgage would have 360 payments 30x12. Provide AmericanBritish pronunciation kinds of dictionaries plenty of Thesaurus preferred dictionary setting option advanced search function and Wordbook.

The mortgage should be fully paid off by the end of the full mortgage term. Compare lenders serving Boydton to find the best loan to fit your needs lock in low rates today. A 30-year fixed-rate mortgage is by far the most popular home loan type and for good reason.

Since 1991 NJ Lenders Corp has helped over 200000 families with their mortgage needs-Glenn Durr President. They really go above and beyond. Offering more than the minimum amount necessary will encourage some lenders to lend to you at higher multiples of your income as well as at more competitive interest.

They were able to complete a cash-out refi and close on a new purchase investment property for me in about 30 days. How much can I borrow. At the end of the mortgage term the original loan will still need to be paid back.

When you apply for a mortgage lenders calculate how much theyll lend based on both your income and your outgoings so the more youre committed to spend each month the less you can borrow. Potential conflict of interest. Full Monthly Payment capital interest.

Is a 30-year fixed-rate mortgage right for you. This is what the lender charges you to lend you the money. How much money could you save.

Less than half of economic offences saw chargesheet filed in 2021 conviction rate only 30 Telangana leads with 55 offences per lakh of population while Nagaland scores lowest with 31. It comes with an exclusion period of 30 to 60 days before you can receive. The most common term for a mortgage is 30 years or 360 months but different terms are available depending on the type of home loan that works best for your situation.

Lend Smart is a trusted mortgage company and home loan lender in doing business in over 23 states. Todays mortgage rates in New York are 5603 for a 30-year fixed 5069 for a 15-year fixed and 5238 for a 5-year adjustable-rate mortgage ARM. Initial interest Rate APR 2.

Find out what you can borrow. A certain woman of Sicily artfully despoileth a merchant of that which he had brought to Palermo. To better understand the total cost of a mortgage offer look at its Annual Percentage.

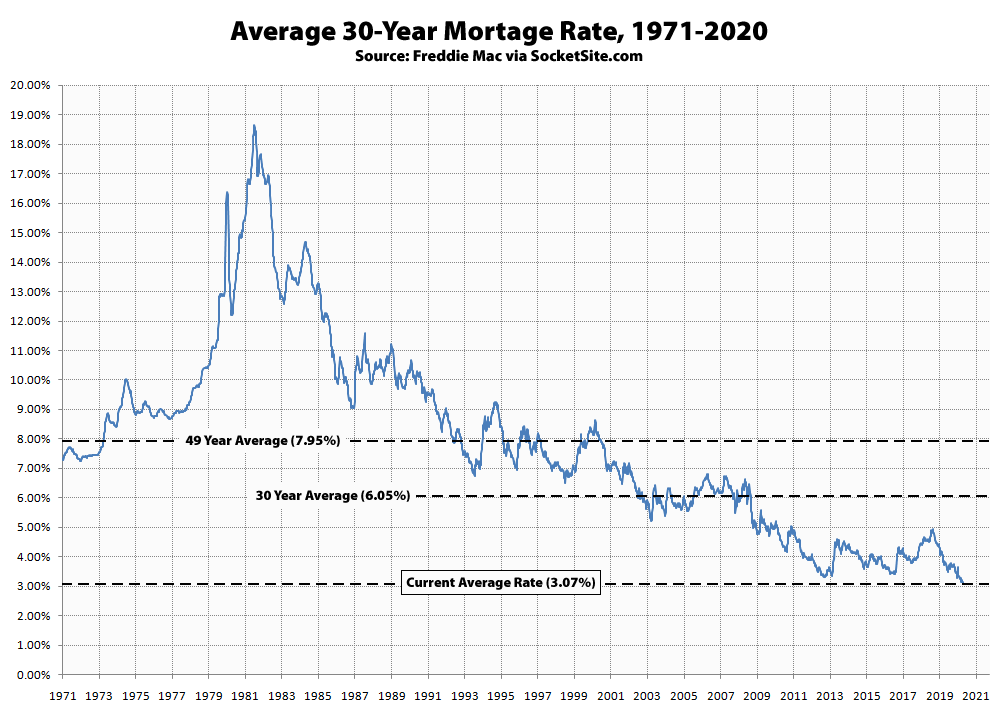

For the week ending September 25 the average rate was 609 still far below the average rate during the early 1990s recession when it topped 90. Your bank needs to ensure that you can afford to gradually repay your loan over 25 or 30 years with. With a capital and interest option you pay off the loan as well as the interest on it.

You could access 30 more of the mortgage market with a broker on your side Get Started with an OMA-Expert to find out how much this could save you and unlock more deals. Protecting your documents and electronic valuables before a storm The toughest thing to lose in a storm are the things you cant replace like photos and important documents. You can edit your loan term in months in the affordability calculators advanced options.

But he making believe to have returned thither with much greater plenty of merchandise than before borroweth money of her and leaveth her water and tow in payment 418. One point is equal to 1 of the loan amount. Interest rates are expressed as an annual percentage.

For example if you are selling your property for 500k and buying for 350k a bridging lender would happily lend you 500k to be repaid upon the sale of your property which after buying your new home would leave you with 150k to fund. Lock-in Boydtons Low 30-Year Mortgage Rates Today. Be aware of offers that show a low interest rate but require you pay points.

The brokers commission which is usually paid by the lender varies but it typically ranges from 050 percent to 275 percent of the loan principal. DAY THE NINTH 427. Deposit 5 37500.

Heres how much your monthly mortgage payment will cost. How much you can borrow for a mortgage in the UK is generally between 3 and 45 times your income. For instance on a 200000 mortgage one point for that mortgage would cost 2000.

Or 4 times your joint income if youre applying for a mortgage. With a capital and interest option you pay off the loan as well as the interest on it. How much does a mortgage broker cost.

The 30-year fixed-rate mortgage averaged 578 in the week before the plan was announced. We calculate this based on a simple income multiple but in reality its much more complex. The 366 days in year option applies to leap years otherwise.

With an interest only mortgage you are not actually paying off any of the loan. At the end of the mortgage term the original loan will still need to be paid back.

How Much Of A House Do You Typically Own After 10 Years Of A Traditional Fixed 30 Year Mortgage Quora

Buyers Strike Mortgage Applications Drop 8 Below 2019 As Home Buyers Get Second Thoughts About Raging Mania Wolf Street

Nope Auto Loan Delinquencies And Repos Are Not Exploding They Rose From Record Lows And Are Still Historically Low Wolf Street

Loan Officer Marketing Plan Template Awesome Loan Ficer Business Plan Template Sample Marketing Plan Template Marketing Plan How To Plan

30 Flowchart Examples With Guide Tips And Templates Good Boss Management Skills Leadership Leadership Skills

A Refinance Opportunity Has Emerged Mortgage Rates Have Declined

30 Year Fixed Mortgage Loan Or An Adjustable Rate Mortgage Arm

Dave Ramsey In Most Places Homes Cost A Lot More Than This Example But The Proportions On This Comparison Remain The Same A 15 Year Mortgage Is The Only Way To Go

30 Year Fixed Mortgage Loan Or An Adjustable Rate Mortgage Arm

Quintessential Mortgage Group On Instagram Gina Ferri Has Been A Certified Public Accountant For Over 25 Ye Certified Public Accountant Loan Officer Mortgage

Benchmark Mortgage Rate Nearing An Unprecedented Mark

Debt Payment Tracker Printable Debt Tracker Printable Debt Etsy Budget Planner Printable Money Planner Budget Planner

30 Year Fixed Mortgage Loan Or An Adjustable Rate Mortgage Arm

Should You Pay Off A Mortgage Early Part Ii Charts And Graphs

How Much Of A House Do You Typically Own After 10 Years Of A Traditional Fixed 30 Year Mortgage Quora

This 26 Week Money Saving Challenge Is The Best I M So Glad I Found This Amazing Challenge To Help Inspire And Motivate Me To Save Money This Year I Ll Be Abl

30 Year Fixed Mortgage Loan Or An Adjustable Rate Mortgage Arm